Dolibarr ERP & CRM is a browser-based and easy-to-use software.

In the Dolibarr settings, the accuracy for rounding (decimal places) and the general behaviour for rounding amounts can be defined.

There are two different methods for calculating VAT. The column-wise (vertical) calculation or the row-wise (horizontal) calculation.

In the vertical calculation, the net total per tax rate is determined for the entire invoice and the VAT total is calculated from this In the horizontal calculation, the VAT is calculated for each individual item line, taking into account the respective tax rate

Both methods of calculation are legally permissible, but can lead to rounding differences in the case of decimal places.

Example:

Item 1:

Item price of 0.99 EUR + VAT 19% = gross price 1.18 EUR

Item 2

Item price of 0,99 EUR + VAT 19% = gross price 1,18 EUR

Position 3:

Item price of 0,99 EUR + VAT 19% = Gross price 1,18 EUR

Calculation: (0,99 EUR + 0,19 EUR) x 3 = 3,54 EUR

Depending on the selected calculation, this results in rounding differences of 0.01 EUR. To create invoices without rounding differences in Dolibarr, the following settings must be changed.

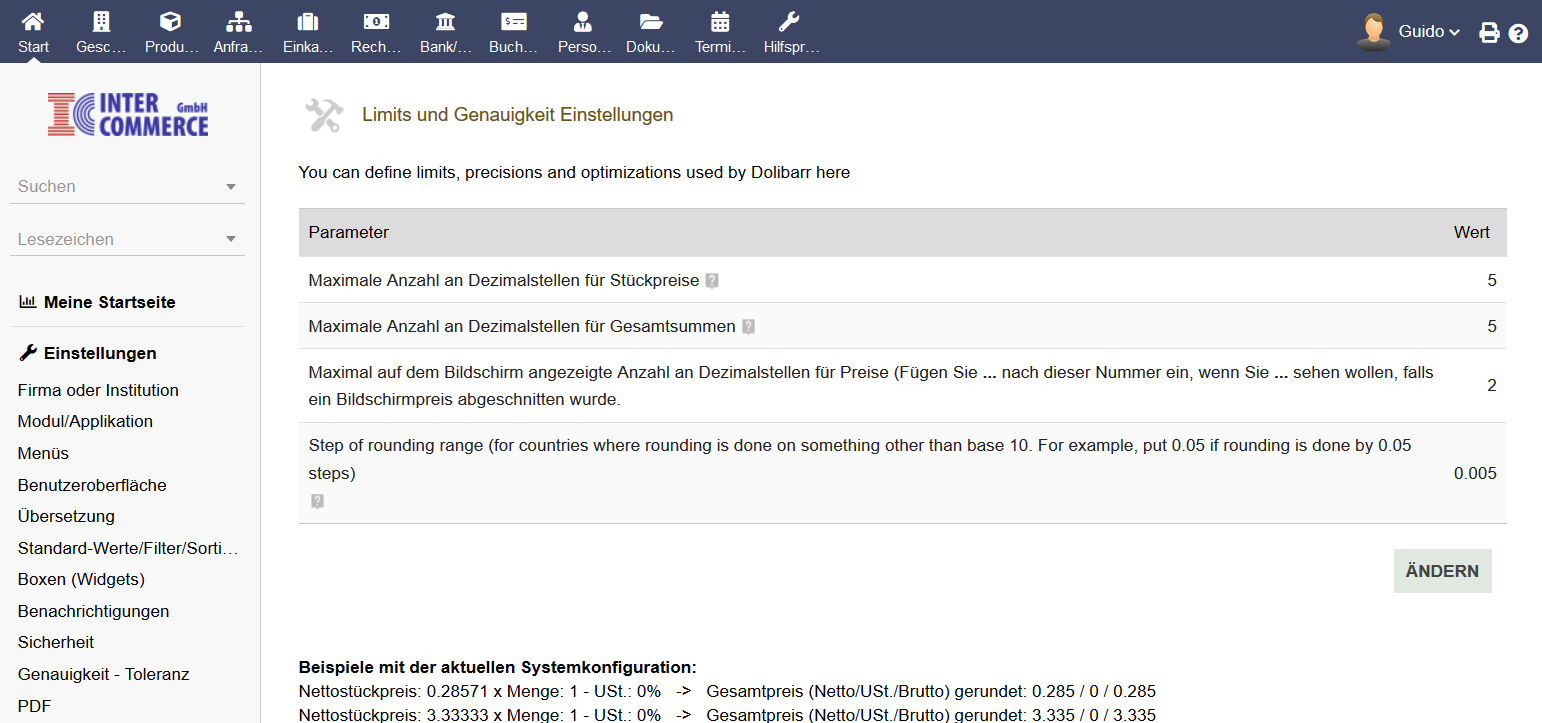

Start -> Settings -> Accuracy – Tolerance

Maximum number of decimal places for totals = The number of decimal places for the total price.

Maximum number of decimal places displayed on the screen for prices … = The number of decimal places displayed on the screen.

Start -> Settings -> Advanced settings

Add the following entry as a new parameter:

“MAIN_ROUNDOFTOTAL_NOT_TOTALOFROUND” (Enter without quotes.)

… and set the value to “1” to activate it.